Choosing between an ECN and an STP forex broker matters because the broker’s execution model changes your real-world costs, the predictability of fills, how orders behave in volatile moments, and what legal/operational frictions you will face. The labels ECN and STP are often used in marketing, sometimes loosely, but they point to different plumbing and different trade-offs. Below I describe how each model works in practice, list the operational and economic consequences you should expect, show direct comparisons in tables, and give practical guidance on which model is likely to suit different trader profiles. This is a functional, operational guide — not a sales pitch — intended for someone who already understands basic forex mechanics and who wants to pick the execution model that reduces surprises and supports their strategy.

This text will focus on the actual difference between the two broker types. If you’re looking to find a broker to trade with, then we recommend that you read this article to decide what type of broker you want to use and then visit ForexBrokersOnline.com to read their reviews to find a good broker of the type you prefer.

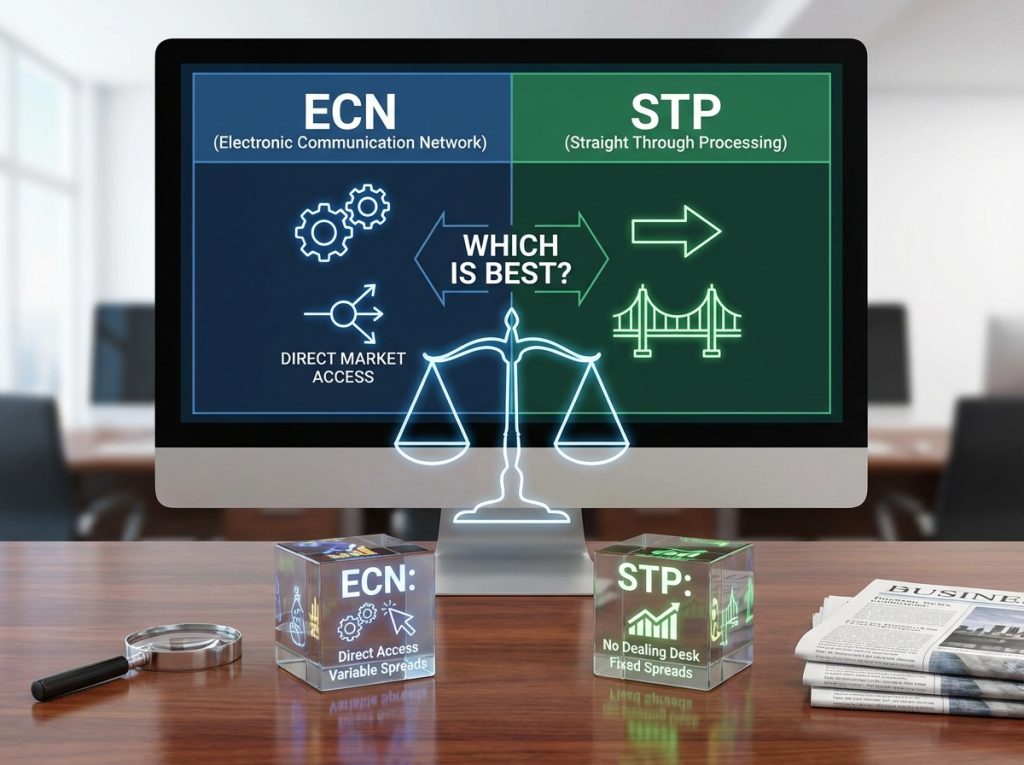

How the two models work in practice

An ECN model exposes orders to a multi-participant liquidity pool or order book and typically separates raw spread from explicit commission. You see narrower “raw” spreads but you pay a per-lot commission. ECNs publish depth at price levels, let participants post limit liquidity, and are generally preferred where visible depth and price discovery matter. ECN routing tends to be transparent: your order reaches an institutional pool and fills against other participants or market makers quoting on that pool. Because pricing is raw, you get clearer information about the market’s available liquidity, which helps when you need to work larger sizes or rely on a displayed order book.

An STP (straight-through processing) model aggregates prices from multiple liquidity providers and forwards retail orders to those providers; the broker may add a small markup or take part of the spread. STP accounts often present blended quotes and sometimes do not charge an explicit commission, instead embedding the broker’s margin inside the spread. In many retail implementations STP is a pragmatic middle ground: execution is usually straightforward, spreads are reasonable for small and medium tickets, and the model reduces the administrative friction of separate commission accounting. STP routing behaviour varies across brokers — some genuinely pass flow to external LPs; others blend, internalise or switch between internalisation and external routing based on size or volatility.

Real practical differences that affect trading performance

The headline differences (raw spread + commission vs blended spread) are only the start. ECN execution is typically more transparent and better for large or institutional-sized orders because depth is visible and fills scale more predictably with size. ECN models are often preferred where you must place limit orders into the book and expect them to rest or be executed by other participants. STP models can be more convenient and cheaper for small retail tickets because the blended spread plus no commission often yields a lower all-in cost at those sizes, and STP platforms are designed to simplify billing and order handling. Execution crazes like requotes, widened spreads during news, and unexpected stop behaviour show up differently: ECNs will show the market widening and fills will reflect that; STP brokers sometimes widen advertised spreads or reprice client orders to manage exposure.

Operationally you should also expect differences in reporting: ECN providers commonly give clearer execution reports and tick data; STP platforms sometimes provide only aggregated fills and less transparency about upstream liquidity. Counterparty risk differs too: ECN fills often imply direct exposure to the book and clearing counterparties; STP brokerages that internalise flow may add a credit element because the broker can be the counterparty to client trades. In short, the practical consequences are about price transparency, scale, and counterparty economics — not about which label sounds better in a brochure.

Feature comparison table

| Feature / concern | ECN (typical) | STP (typical) |

|---|---|---|

| Pricing structure | Raw (very tight) spreads + explicit commission per lot | Blended spreads (wider) often commission-free or small commission included |

| Order book visibility | Often available (market depth) | Usually not visible; broker shows consolidated/blended quotes |

| Best ticket size | Medium to large — scales well | Small to medium — cost effective for retail tickets |

| Execution transparency | High — explicit fills, routing logs often available | Medium — routing may be opaque unless reported |

| Average slippage profile | Lower at scale; variable in ultra-thin hours | Lower for small trades in normal hours; may widen at peaks |

| Requotes / rejections | Rare on true ECNs; dependent on liquidity | Possible if broker internalises or adjusts during volatility |

| Commission accounting | Clear per-lot fees (easy to compute all-in cost) | Cost embedded in spread — harder to separate components |

| Suited for scalping/high frequency | Commonly used by scalpers if allowed | Some STP brokers also allow scalping, but fills may be less predictable |

| Stop-order behaviour during gaps | Reflects upstream book; may gap through | May be subject to broker’s stop handling policy (check T&Cs) |

| Cost predictability | High (explicit commission + raw spread) | Lower (blended spread varies) |

| Counterparty exposure | Depends on clearing; often less broker principal risk | Mixed — broker may internalise flow creating principal exposure |

| Typical regulatory / institutional use | Favoured by institutional traders | Favoured by retail brokers and some institutional desks |

Pros and cons summary table

| Model | Pros | Cons |

|---|---|---|

| ECN | High transparency; narrow raw spreads; better depth for larger orders; commissions make pricing predictable; good for visible limit order placement | Explicit commissions can look costly on small tickets; depth can evaporate in thin hours; some ECNs have minimum sizes or additional fees; not all ECNs permit every retail strategy |

| STP | Simpler billing (often no explicit commission); generally good spreads for small retail orders; simpler user experience; many brokers offer local support and integrated account tiers | Blended spreads hide broker markup; routing can be opaque; possible internalisation or desk intervention in stress; hard to verify true upstream liquidity without execution logs |

Which one is best for you — practical decision rules

Deciding which model suits you depends on three pragmatic variables: ticket size and frequency, strategy sensitivity to execution and depth, and your tolerance for opaque pricing.

If you trade small ticket sizes, trade infrequently, or you prefer a simpler billing model, an STP (or a transparent hybrid that publishes both spread and commission equivalents) is often the better choice. For many retail swing traders and part-time traders the blended spread plus simple UX keeps bookkeeping simple and the all-in cost for typical lot sizes is competitive. STP also tends to be friendlier for accounts that rely on mobile app convenience and do not need order book depth.

If you trade larger sizes, need visible depth, place resting limit orders into a displayed book, or run strategies where slippage at scale is business critical, ECN is the better option. ECN’s predictable, measurable cost model (raw spread + commission) makes it possible to model price impact and scale position sizes without discovering a non-linear jump in cost. Professional scalpers, institutional traders or those who want to place and profit from limit liquidity will generally prefer ECN execution.

There is a middle path. Many brokers operate hybrid models that function STP for small tickets and ECN for institutional flow, or they offer an “ECN style” account tier with raw spreads and commissions. Hybrids often deliver the best of both for a broad set of retail traders — but they demand more diligence because the routing rules matter: does the broker switch routing based on size, time, or client tier? Ask for a routing disclosure and an example execution report.

Practical examples by trader profile

For a casual swing trader with a single-figure number of trades per month, modest position sizes and a desire for no fuss, STP or a hybrid retail account is usually better: lower friction, no separate commission reconciliation, and adequate execution for the trade sizes that matter. For a full-time trader running multiple lots and preferring to scale with visible depth, ECN gives the necessary transparency to model slippage and to place limit liquidity without unexpected internalisation.

If you scalp tiny ticks many times a day, ECN is conceptually superior because of raw spreads and depth, but check the broker’s policy — some ECNs restrict scalp frequency or charge minimum commission per trade which can eat micro profits. Conversely, some STP brokers explicitly allow scalping and will be a practical choice for small-time scalpers because real-world fills and low overhead trump theoretical micro advantages.

How to evaluate a broker empirically (the test you must run)

Labels aren’t enough. The right way to choose is to test the broker with the actual tickets and the actual hours you plan to trade. Run a funded micro test and collect the following for a sample of 30–50 representative trades across quiet and eventful periods: quoted spread at order time, executed fill price, slippage, execution latency, and the published overnight financing if you hold positions. For ECN accounts track the per-lot commission and compute all-in cost per round trip; for STP accounts compute the effective commission by measuring spread + slippage and comparing to a benchmark mid. Do a small deposit and a small withdrawal to validate the cash-out mechanics. Ask for an execution report that shows upstream fills and routing; treat refusal to provide execution logs as a red flag if transparency is your objective.

Below is a compact checklist table you can use when you test a given broker.

| Validation step | What to look for |

|---|---|

| Quoted vs executed spreads | Average difference should be small; record both at the same timestamp |

| Commission transparency | ECN: confirm per-lot fee; STP: measure effective cost from spread data |

| Routing disclosure | Request written routing policy and sample execution report |

| Stop handling | Test stops in low liquidity hours to see slippage behaviour |

| Withdrawal test | Make a small profit withdrawal to validate timeline and fees |

| Funding rails | Confirm deposit and withdrawal rails and legal entity receiving funds |

| Demo parity | Verify that demo fills materially match live fills by running identical orders |

| Customer support response | Time to resolve execution or withdrawal queries under stress |

Common misperceptions and pragmatic cautions

Many retail traders treat ECN as inherently “better” because a raw spread sounds cheaper. The practical truth is that ECN’s advantage emerges when you trade at scale or when depth matters. For tiny retail tickets the commission overhead can exceed the improvement in spread, so STP or a hybrid is often cheaper for real net P&L. Conversely, don’t assume STP is always a stealth tax: excellent STP providers publish their liquidity providers, execution policies and maintain consistent spreads. The deciding factor is operational behaviour under stress: how the broker handles spikes, whether stops get executed at reasonable prices, and whether withdrawals are transparent.

Also, marketing often conflates ECN with lower latency and STP with slower execution. In reality latency depends more on connectivity and the broker’s infrastructure than on the nominal routing model. A well-engineered STP broker with robust connectivity can out-execute a clumsy ECN setup. Test, measure, and prefer measured behaviour over labels.